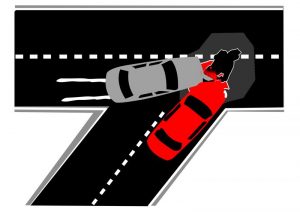

Car accidents in Greenville NC: Un-Insured Motorists and Wreck Cases with injuries in North Carolina

- What does UM and UIM mean in North Carolina personal injury law?

- When does under insured insurance coverage come into play in a NC wreck case?

- What’s the difference with un-insured motorist claims and law suits?

- What happens in a accident when the other person is not insured?

The Dodge Jones Personal Injury Law Firm helps people present legal claims in wreck cases. If you have injuries from a car accident, motorcycle wreck, or semi-truck collision, we’re here to help answer your legal questions. Our law firm and attorneys provide a FREE consultation on all matters involving NC wrecks and personal injury claims for money damages.

Question 1: What happens in a accident when the other person is not insured or does not have enough insurance or the right type of insurance for a personal injury case in NC?

Under the NC laws for accident cases, there MAY be some level of protection for the person hurt as a result of the wreck who is seeking to make a claim for personal injuries. Even if the other, at-fault driver did not have accident insurance or some other insurance coverage, many NC insurance policies have protections for the injured party or motorist. (That’s because passengers in vehicles with personal injury claims may be protected under the North Carolina accident laws.)

PI lawyers may refer to legal claims where there is NOT ENOUGH insurance as an UNDER INSURED MOTORIST legal cause of action.

Personal injury lawyers often refer to another, separate type of insurance as UM or Un-Insured Motorist coverage. That’s when the at-fault driver in a wreck case has allowed their car insurance policy to lapse or otherwise just does not have motorist insurance in NC.

One of the things that is of great concern to people who’ve been injured in an accident, an automobile accident is whether or not there’s enough insurance to cover the claim.

Sometimes we’re dealing with a hit and run.

Sometimes we’re dealing with a driver who doesn’t run but doesn’t have insurance and then sometimes we’re dealing with a driver that has the minimum insurance and your medical expenses and your lost wages and your claim are much higher than that minimum.

MORE INFO: After an accident when should I see a Doctor?

In that circumstance, you’ve got two types of coverage under your policy, hopefully, uninsured motorist coverage and underinsur

ed motorist coverage.

Question 2: What is Under Insurance Coverage under the North Carolina car accident laws?

Under Insured Motorists are people who may have SOME level of insurance for a personal injury claim involving a car accident, but the level or amount of insurance coverage is not enough to cover damages from the wreck. North Carolina law requires certain minim

ums for car insurance policies.

It’s something that would be filed in any case where it looks like that were going to get passed the underlying limits of the defendant driver.

Policy and the thing that a lot of people don’t realize about that is that your insurance company, the company that you may have been with for a very long time that you think a lot of will suddenly become the enemy.

They will take the place of that person who hit you and they will defend that person as if he or she was their insured against you.

MORE INFO: Litigation Results for Personal Injury Claims in NC

You have to keep that in mind when you’re dealing with your own insurance company that they are not necessarily looking out for your best interest, especially if you’re dealing with an uninsured or an underinsured claim with your own company.

I’m Kevin Jones. If you have any questions about a car accident, a motorcycle accident, boating accident, a dog bite case, slip and fall, give me a call.

I’m happy to sit down and talk with you about your case and see what we can do to help.

Thanks!

1801E

North Carolina Workers' Compensation News

North Carolina Workers' Compensation News